If you are financially disciplined, fairly organized and have the ability to use plastic for purchases without getting into debt, relying on travel credit cards for all your spending and bills can make a lot of sense.

After all, cards in this niche let users earn hotel points, airline miles or flexible rewards for travel for each dollar they spend. The best cards also come with generous sign-up bonuses that can be worth hundreds (or thousands) of dollars right off the bat, along with perks like airport lounge access, annual travel credits or automatic elite status.

Still, a lot of consumers feel overwhelmed by the number of travel credit cards on the market today. There are also too many travel rewards programs to count, and they all seem to operate in their unique way. This guide will go over the most important factors in the world of travel credit cards, including the types of cards to look out for, potential benefits you can get and some of the best ways to redeem rewards for maximum value.

Types of Travel Credit Cards

Travel credit cards come from issuers themselves, but they can also be offered through partnerships with hotel and airline loyalty programs. This is why you see credit cards from issuers like American Express and Chase that earn points within their own issuer programs, along with airline and hotel credit cards that earn points or miles in programs like Delta SkyMiles or Hilton Honors.

The chart below shows the type of travel credit cards currently on the market today, the type of rewards they earn and their average annual fees.

| | Type of rewards | Redemption options | Annual fees | Examples |

| Airline credit cards | Airline miles | Typically redeemable for flights, seat upgrades, checked bags and other flight-related redemptions | $0 to $650 | Delta SkyMiles® Platinum American Express Card

Citi® / AAdvantage® Executive World Elite Mastercard® |

| Hotel credit cards | Hotel loyalty points | Typically redeemable for free hotel nights, suite upgrades and some other flexible options | $0 to $650 | Marriott Bonvoy Brilliant® American Express® Card

World of Hyatt Credit Card |

| Flexible travel credit cards | Flexible travel rewards points | Can be redeemed for travel through a portal, transfers to airline and hotel programs and other flexible options | $95 to $695 |

Chase Sapphire Preferred®

The Platinum Card® from American Express |

Note that travel credit cards are available for consumers and for small businesses and that many business owners and solopreneurs have both types of cards. Some rewards programs (like Chase Ultimate Rewards and American Express Membership Rewards) let members pool all the rewards they earn across multiple cards in a single account, so small business owners often seize the opportunity to maximize rewards on both their personal and business spending.

A woman booking travel with a credit card. (Photo Credit: Kay A/peopleimages.com/Adobe Stock)

Travel Credit Card Benefits

Picking a travel credit card requires consideration of more than the type of rewards you want to earn. You also need to consider the perks and features you want the most, as well as how much annual fees you're willing to pay (if any at all). While travel credit cards with fees on the higher end of the scale seem expensive, they tend to come with benefits that can more than offset the annual cost.

Here's an overview of the most common premium travel credit card benefits that are available today.

- Airport lounge access: Some airline credit cards offer automatic membership in their own airport lounge programs (e.g. Delta Sky Clubs or American Airlines Admirals Clubs). Others offer general airport lounge memberships like Priority Pass, which includes entry into more than 1,500 airport lounges around the world.

- Annual travel credits: Some travel credit cards offer annual travel credits that apply to general travel purchases or travel purchased through a specific portal.

- Automatic elite status: Hotel credit cards are known for offering automatic elite status just for being a cardholder.

- Free checked bags: Most airline credit cards offer free checked bags for the cardholder and a certain number of passengers on their itinerary.

- Fee credits for Global Entry or TSA PreCheck: Premium travel credit cards tend to offer fee credits that make joining programs like Global Entry, NEXUS or TSA PreCheck free every four years.

- No foreign transaction fees: Most travel credit cards don't charge additional fees when you use the card for purchases overseas.

- Point transfers: Flexible travel credit cards that earn points in programs like Amex Membership Rewards, Capital One Miles, Chase Ultimate Rewards and the Citi ThankYou program let members transfer their points to a range of airline and hotel programs.

- Priority boarding: Airline credit cards tend to let cardholders and travelers on their itinerary board the plane before other groups.

- Travel insurance: The best travel credit cards offer travel insurance benefits like trip cancellation and interruption coverage, travel delay insurance and coverage for lost or delayed baggage.

Best Travel Credit Cards On the Market Today

If you're considering picking up a rewards credit card for your next trip, you should know about some of the best travel credit cards available and what they have to offer. The chart below highlights some top-tier travel cards from all the major programs and their most important details.

| Card Name | Rewards Rate | Notable Benefits | Best Redemption Options | Annual Fee |

| Chase Sapphire Preferred® Card | 1X to 5X points | | Redeem for travel through Chase portal or point transfers to Chase airline and hotel partners | $95 |

| Chase Sapphire Reserve® | 1X to 10X points | $300 annual travel credit Priority Pass Select membership Fee credit for Global Entry, NEXUS or TSA PreCheck membership Travel insurance 50% more value when redeeming points for travel through Chase

| Redeem for travel through Chase portal or point transfers to airline and hotel partners | $550 |

| Capital One Venture X Rewards Credit Card | 2X to 10X points | $300 annual travel credit Priority Pass Select membership Capital One lounge membership Fee credit for Global Entry or TSA PreCheck membership 10,000 anniversary bonus miles

| Redeem for travel through Capital One Travel or point transfers to airline and hotel partners | $395 |

| Wells Fargo Autograph℠ Card | 1X to 3X points | | Redeem for travel through Wells Fargo, PayPal purchases, gift cards and more | $0 |

| Ink Business Preferred® Credit Card | 1X to 5X points | | Redeem for travel through Chase portal or point transfers to airline and hotel partners | $95 |

| World of Hyatt Credit Card | 1X to 4X points | | Redeem for hotel stays with World of Hyatt | $95 |

| Citi® / AAdvantage® Platinum Select® World Elite Mastercard® | 1X to 2X miles | | Redeem for flights with American Airlines and its oneworld partners | $0 the first year, then $99 |

Best Ways to Redeem and Maximize Travel Rewards

When it comes to maximizing travel rewards you earn through credit card spending or travel purchases with a specific brand, some strategies can help you travel further, stay somewhere nicer or get more bang for your buck overall. Here's a rundown of some of the best redemptions you can get with travel credit cards from various programs.

Transfer Flexible Travel Points to Airlines and Hotels

First off, you should know that point transfers to airline and hotel partners can offer outsized value when compared to other redemption options. This isn't always the case, however, so you'll want to do some digging and comparison shopping before you transfer rewards to an airline or hotel program.

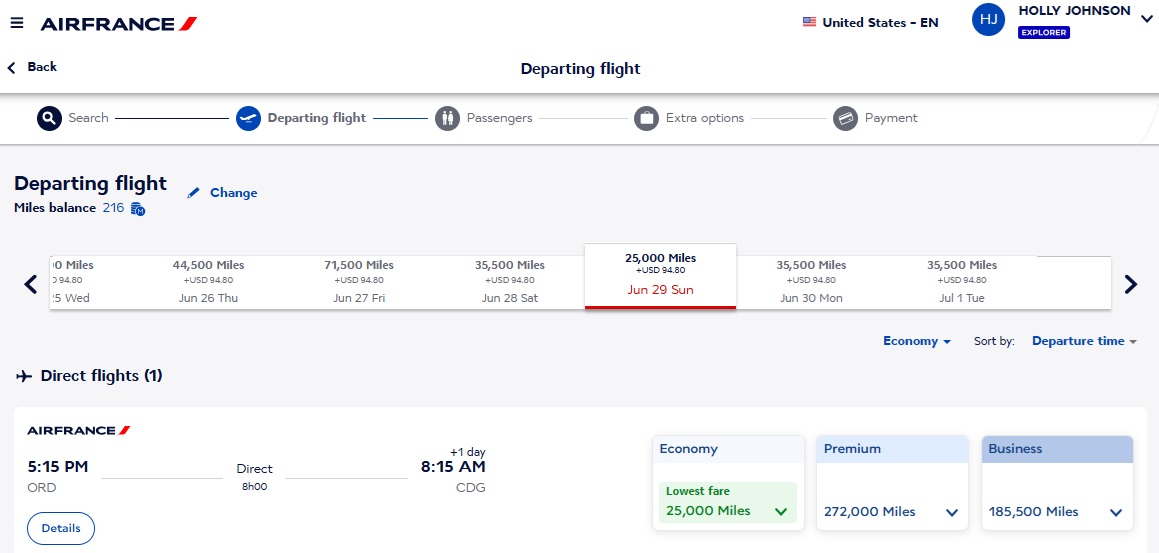

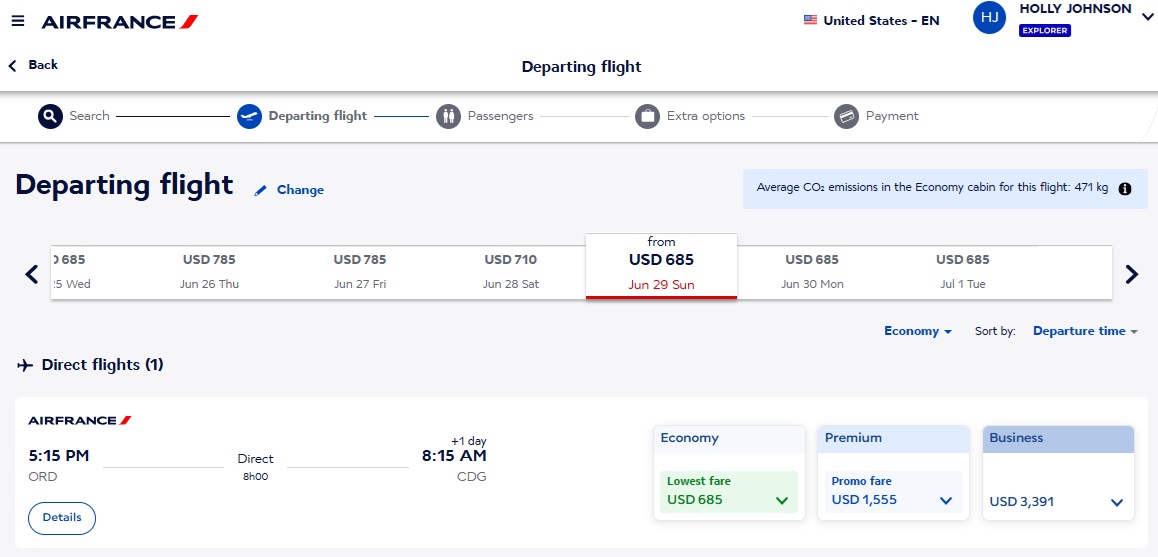

As an example, consider the Air France (Flying Blue) airline loyalty program. This program is easy to earn rewards in since Flying Blue is a transfer partner of Amex Membership Rewards, Capital One, Chase and the Citi ThankYou program.

If you transfer points from any of these programs, you can easily find premium travel redemptions if you can be somewhat flexible with your travel dates and destinations. For example, we found non-stop economy class flights from Chicago, Illinois (ORD) to Paris, France (CDG) for 25,000 miles plus $94.80 in airline taxes and fees.

However, the same flight costs $685 if you paid in cash. If you subtract the airline taxes and fees, this redemption would net you approximately 2.3 cents per mile in value.

This is better than the 1 cent per point in value you would get for booking travel with Amex through AmexTravel.com, or with Capital One Travel and a Capital One travel credit card.

Redeem Chase Points through Chase Travel

If you have a Chase travel credit card like the Chase Sapphire Preferred Card or Chase Sapphire Reserve®, you should know that these cards offer better redemption options when you redeem points for travel through Chase itself. In fact, the Chase Sapphire Preferred offers 25 percent more value for these redemptions, whereas the Chase Sapphire Reserve offers 50 percent more value.

This makes flexible travel redemptions through Chase an especially good deal, and particularly if you have the Chase Sapphire Reserve. After all, this redemption value lets you get 1.5 cents per point, and you can book airfare with any airline, hotel stays with any brand, car rentals, activities and more.

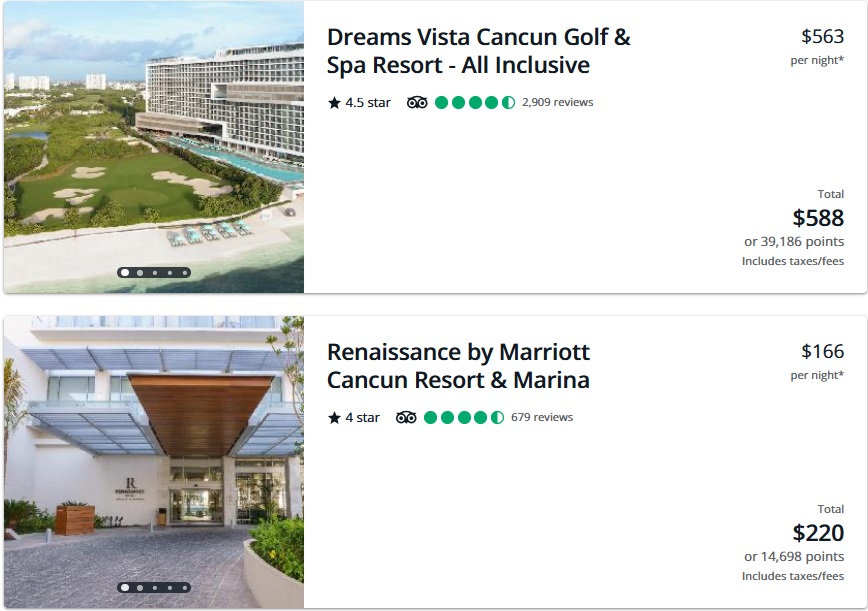

With the Chase Sapphire Reserve, for example, you could stay at the Dreams Vista Cancun Golf & Spa Resort - All Inclusive for $588 or 39,186 points per night, or the Renaissance by Marriott Cancun Resort & Marina for $220 or just 14,698 points per night.

Be Flexible with Flights

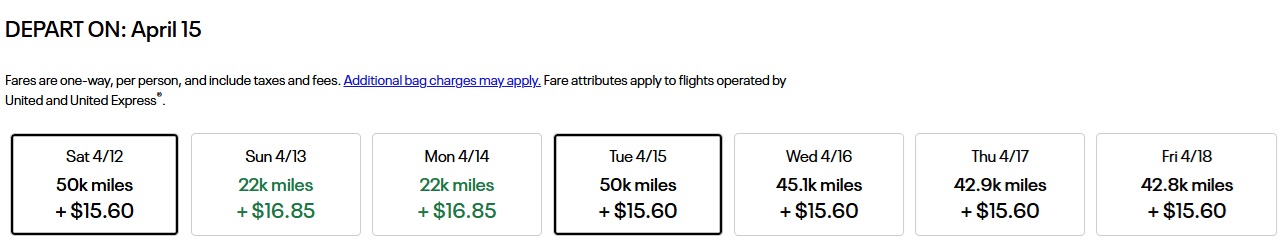

If you plan to use airline miles to book an award flight, you should know that costs in miles (and in cash) can swing up or down dramatically from one day to the next. This makes it possible to save airline miles if you can be flexible with your travel dates, either by traveling during an off-peak month for your destination or being flexible on the day of the week you fly.

Fortunately, most frequent flyer programs offer a way to see the award fares available on multiple days without having to do a different search for every itinerary. As you can see in the screenshot below that shows flights from Newark, New Jersey (EWR) to Aruba (AUA), costs with the United MileagePlus program for this one-way award can vary from 22,000 miles to 50,000 miles depending on the day you fly.

Take Advantage of Free Night Promotions

Also, make sure you know about free night promotions offered through your favorite hotel loyalty program, and take advantage whenever you can. These promotions tend to offer a free night if you use points to book a specific number of consecutive nights at the same property with eligible programs, although you may have to have a travel credit card from the brand to participate.

As an example, Hilton Honors offers a fifth night free at Hilton hotels and resorts for Silver Elite members or higher when they book at least five consecutive nights with points. Marriott Bonvoy has a similar program called "Stay for 5, Pay for 4," and it's available for all of the program's loyalty members regardless of status.

With IHG One Rewards, members who have a co-branded hotel credit card like the IHG One Rewards Premier Credit Card get a fourth night free when they book an award stay with a minimum of four consecutive nights at the same property.

For the latest travel news, updates and deals, subscribe to the daily TravelPulse newsletter.

Topics From This Article to Explore